As commercial real estate professionals, we do our best to keep an eye on industry trends at a micro and macro level. Many factors play into the performance of a market—from local challenges to nationwide changes in the economy, public health, climate change, and more. We saw trends evolve at record rates over the last few years, many of which were already forming pre-Covid.

Retailers instituted new omni-channel sales and marketing tactics to appeal to online shoppers and increased curbside pick-up service. The entire retail ecosystem adapted, and the latest reports are showing “surprising resilience” in the face of grim projections.

CRE practitioners are consistently watching commercial property trends on a national stage. However, it’s imperative to have an in-depth knowledge of the local market to best serve clients. Huntsville and Madison County have fared well throughout the many hurdles of 2020 and 2021. This week, we are looking at trends in other major urban markets throughout the United States.

The Emerging Trends Report is compiled annually by PwC and the Urban Land Institute by gathering data and conducting surveys of CRE professionals across the nation—specifically in markets such as New York City or Los Angeles. Before we continue with national trends, it is important to note that this information does not necessarily reflect the trends we are seeing in Huntsville. The Rocket City moves at a different pace, and we will release a more hyper-local report soon.

Here are some notable trends worth mentioning:

Retail Flexibility

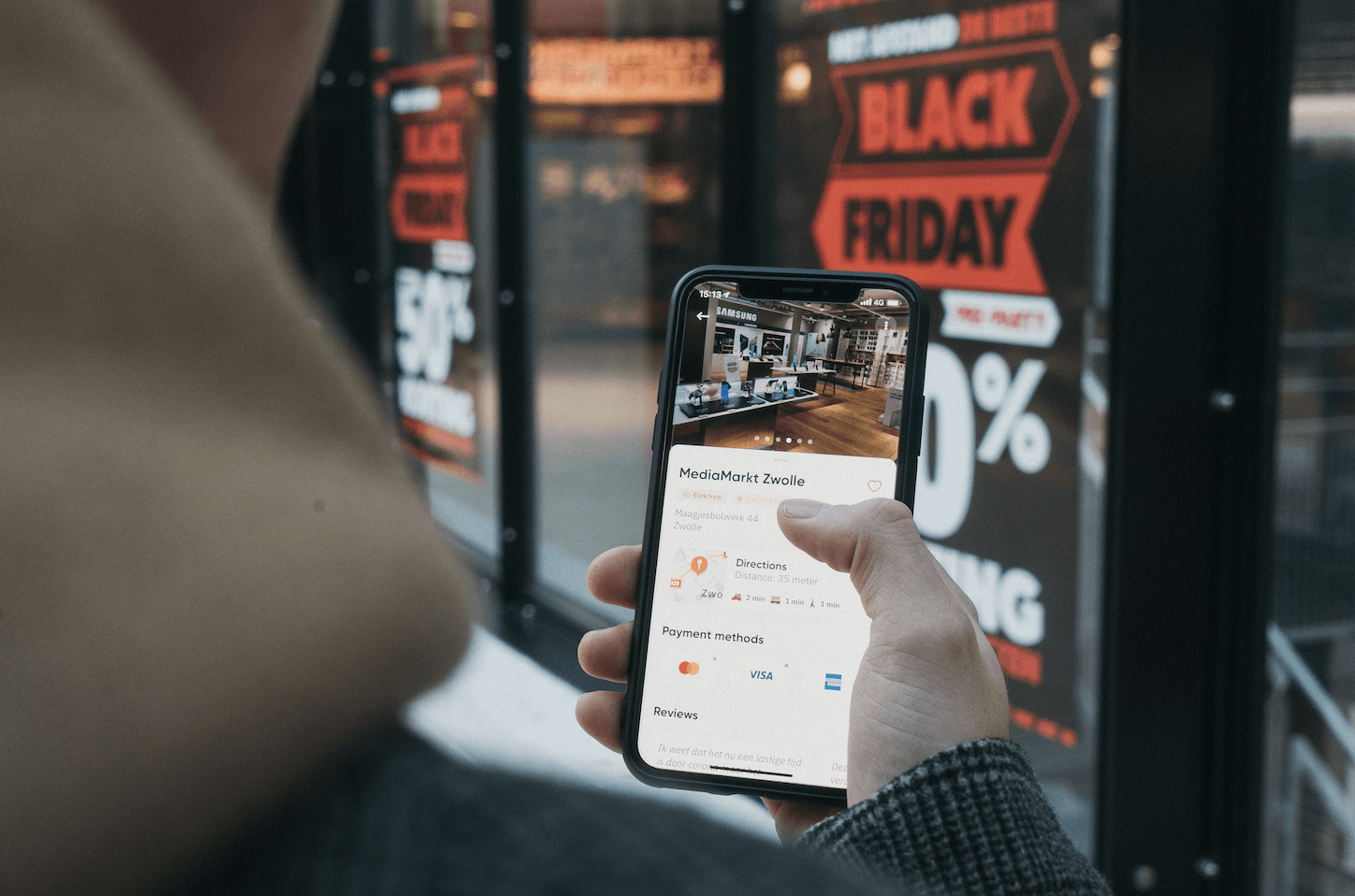

According to the report, “retailers stepped up and demonstrated perhaps even more flexibility than consumers in pivoting to dramatically expand their e-commerce capabilities.” The catastrophic predictions about the future of retail proved unwarranted. That’s not to say the industry didn’t see immense change. But consumers kept spending and increased spending throughout last year.

After a brief plunge in spending during the lockdowns of early 2021, retail sales rebounded with overall sales (including e-commerce) recovering to pre-Covid levels by fall and physical retailers matching pre-Covid levels by the end of the year. It has only continued to grow from there.

Additionally, “new business formations are at their highest level in two decades, with a large share in retailing.”

One major asset manager was quoted saying, “We’re seeing luxury excel, but at the same time, if you look at who’s growing their store fleets, two-thirds of it is dollar stores and discount stores.” Another contributor surveyed said, “There is no middle. For physical retail, it is either got to be about the value or it’s got to be about the experience.”

(Read our post about Experiential Retail here.)

Other major trends included the repurposing of excess retail space, more retailers adopting seamless omni-channel experiences, reconfiguration of spaces for pick-up and curbside service, and the scraping of secondary malls with its land devoted to new mixed uses.

Finally, we’re seeing an increase in brand partnerships within physical stores. Take Khol’s recent attempts to attract younger clientele by adding mini Sephoras in its stores.

Retrofitting Cityscapes

“Adaptation” was the buzzword for retail that included operational shifts to create a seamless experience for buying online and picking up in-store. Store layouts were changed, and shopping and dining were moved outside—so much so that there was a nationwide shortage of propane heaters last winter.

This sudden focus on comfortable outdoor space led to changes in urban streets and sidewalks as local government waived restrictions. Soon, even gyms and salons were offering services outside. Retrofitting cityscapes became a theme as city streets were made more conducive to pedestrian use. “Parklets, outdoor café seating, and retail space replaced sidewalks and slower streets,” said the report.

Physical Offices & Company Culture

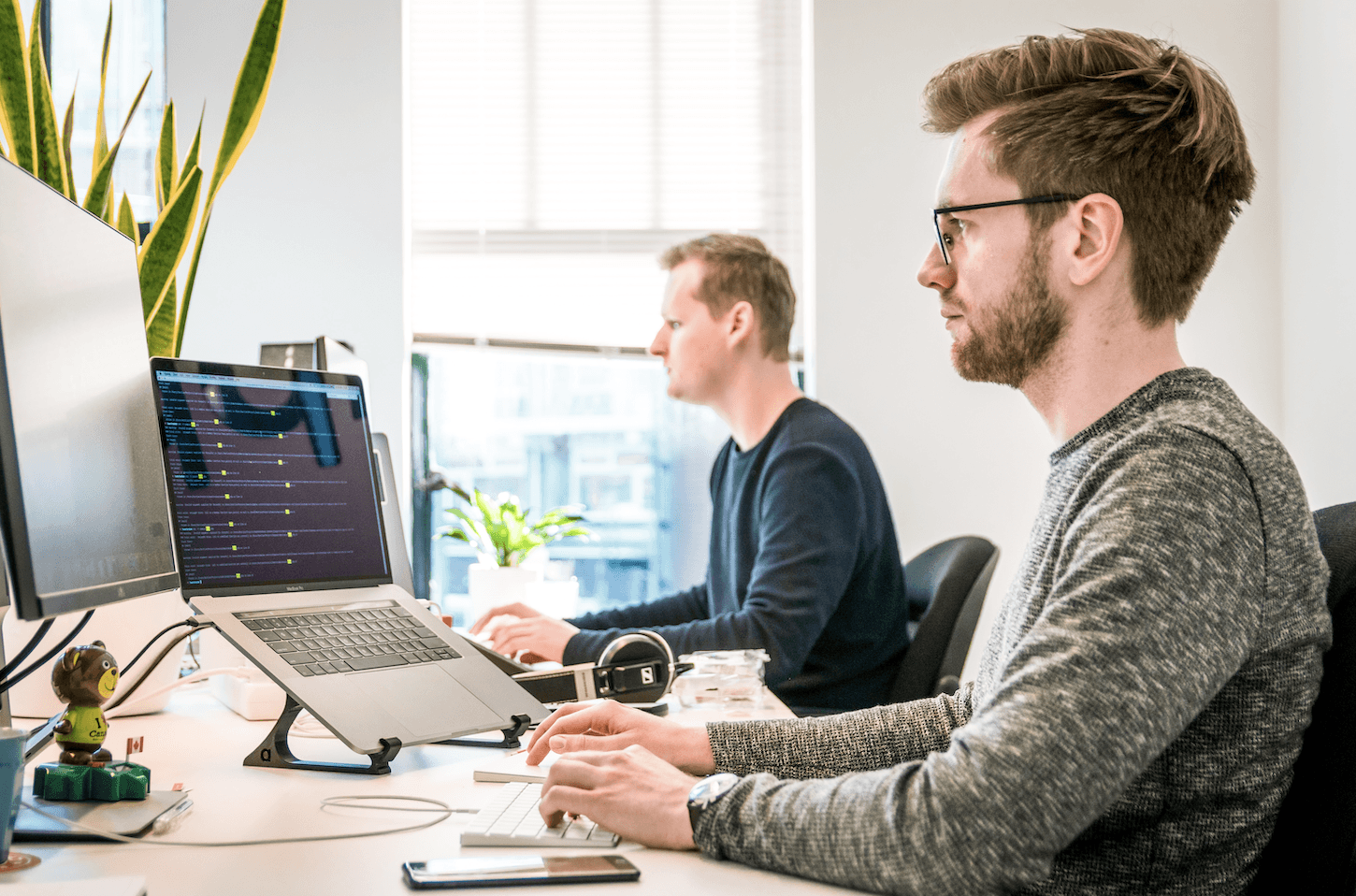

The state of offices post-pandemic has been a topic of conversation for a while. As vaccines rolled out and more people returned to the office, the industry saw a demand for updates to office environments. Remember, Emerging Trends focuses on major markets and what we see in a tertiary market like Huntsville looks different.

It’s expected that future talent will place increased importance on having work flexibility, which can make a difference when competing to hire the best candidates. The main reason why work from home (WFH) continues at the current pace is the demand for talent. Competition for good labor is fierce, and employers are using the WFH opportunity to lure new talent their way. However, the production level of WFH vs. in-office is yet to be seen.

History has examples of long-term WFH experiments that didn’t pan out. For instance, IBM tried to operate with many of its workers in remote settings and eventually had to call them back due to a steep decline in productivity and business. Revenues had dropped 20 quarters in a row. For IBM, proximity boosted efficiency, and it is likely that once the labor market softens other companies will experience the same.

“People can’t advance the shared consciousness and the culture of their firms without people physically being in the office, and people can’t grow their careers without physically being around people in the office,” said the report.

According to Emerging Trends, generational differences will also play a part in how the hybrid work model performs. For instance, younger workers benefit from in-person facetime with superiors and need to be in the office for networking purposes. The culture of an office is also something that can’t be recreated in an online forum. When asked to choose the primary drivers for employees to return to the physical office, the largest number of respondents said to enable company culture, which was quickly followed by enable effective collaboration.

It was noted that, “Firms will need to provide enough space for remote workers to collaborate in person, at least occasionally.”

Other Trends Mentioned

- The increased use of property management technology

- More demand for suburban-based offices

- The bounce-back of the hospitality industry

- The effect of labor shortages

- Increase of telehealth capabilities in medical spaces

The full report can be accessed here.

![]()

Make sure you’re staying on top of the latest trends, newest developments, and hottest new stores in Huntsville by subscribing to our weekly blog updates!

CRUNKLETON COMMERCIAL REAL ESTATE GROUP

INFO@CRUNKLETONASSOCIATES.COM

256-536-8809

DEVELOPMENT | LEASING | BROKERAGE | PROPERTY MANAGEMENT | INVESTMENT CONSULTING