Retail demand in Huntsville remains strong, supported by rapid population growth and above-average household incomes.

As a regional hub for tech, defense, and aerospace, the city continues to attract jobs and disposable income, while lower housing costs compared to the national average boost overall buying power.

A major milestone came with the announcement that U.S. Space Command will establish its headquarters in Huntsville, bringing 1,600–1,800 direct jobs and up to 3,000 spinoff positions. The long-term economic ripple effect is projected to be in the billions.

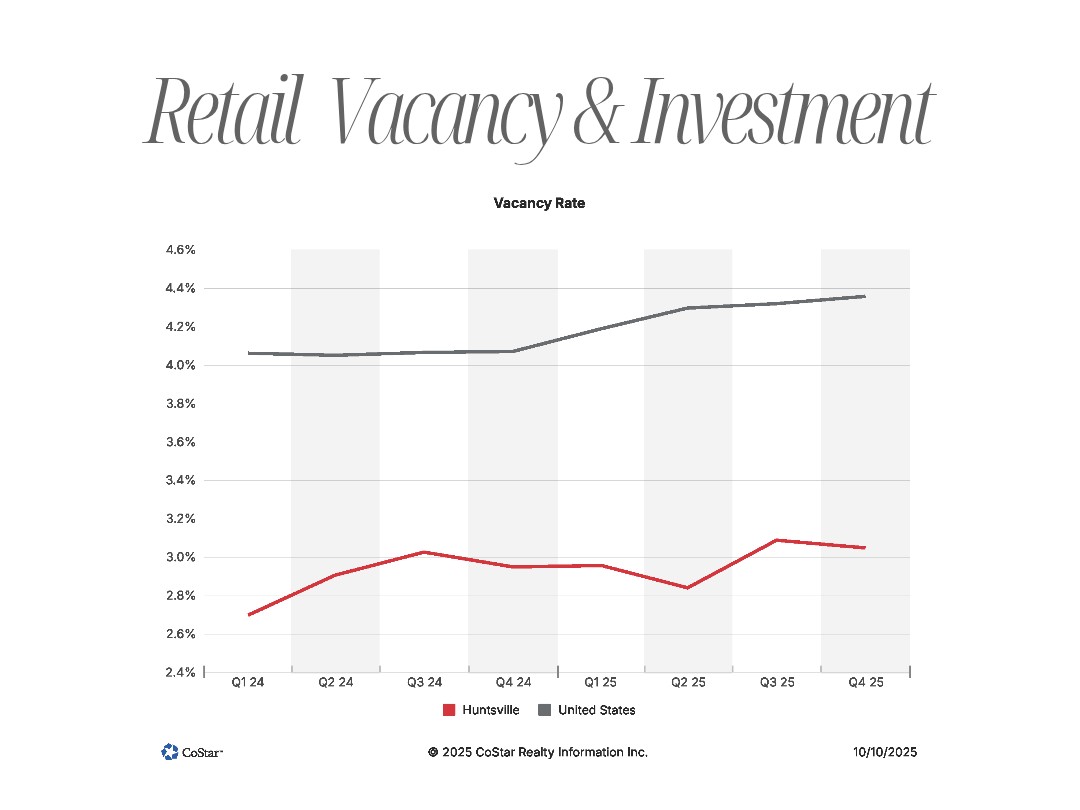

On the retail side, vacancy sits at just 3.0% compared to 4.3% nationally. The market is so tight that many spaces are leased before they ever hit the market, and quality second-generation, move-in-ready space is increasingly rare. Box users are especially active — many groups are still circling Huntsville, often chasing the same limited large-format boxes. At the same time, brands that previously passed on the market are now entering, reflecting Huntsville’s elevated position on national retailers’ expansion maps. This dynamic continues to give landlords leverage.

A standout deal this year was IKEA’s 46,000 SF lease at University Place, marking the brand’s first location in Alabama and signaling confidence in Huntsville’s growth trajectory.

There are still several major mixed-use projects underway in Huntsville — including Front Row, MidCity, and Stadium Commons — which will continue to drive long-term retail growth, attract new tenants, and further shape the city’s urban fabric.

On the investment side, sales volume over the past 12 months totaled nearly $200 million, in line with historical averages. Investor appetite remains strong for well-located neighborhood centers and fully leased assets along major growth corridors. Importantly, many shopping centers are now trading off-market, underscoring the depth of investor demand. In fact, two notable neighborhood center trades closed quietly off-market this year, highlighting how limited supply rarely makes it to public listing.

A notable on-market sale this summer was North Madison Corners, which traded in July for $12.5 million at an 8% cap rate. Additionally, in South Huntsville, a national private REIT sold the 54,00 SF Ashley Furniture building for $7.5 million ($138/SF), further showing investor confidence in Huntsville’s retail fundamentals.

The City of Huntsville has also committed significant investment into North Huntsville, upgrading infrastructure, annexing additional land, and supporting redevelopment efforts. These public investments are setting the stage for stronger retail demand and private investment in historically under-served neighborhoods.

My outlook: the three submarkets to watch are North Huntsville, South Huntsville, and Owens Cross Roads.

Each is experiencing unique growth drivers — from city-backed revitalization efforts in the north, to continued household growth in the south, to expanding rooftops and new retail opportunities in Owens Cross Roads. Together, they represent the next wave of Huntsville’s retail story.

ABOUT THE AUTHOR

Anusha Alapati Davis | Vice President of Retail

Anusha Alapati Davis is Vice President of Retail at Crunkleton Commercial Real Estate Group, specializing in retail leasing with a focus on adaptive-reuse, mixed-use, and high-end food and beverage concepts. A Huntsville native with over 9 years in the industry, she has played a key role in major projects like Twickenham Square, Stovehouse, and Lincoln Mill. Anusha works with local, regional, and national brands, helping create curated tenant mixes backed by strategic merchandising. She represents both landlords and tenants, and her network and market insight drive strong results. Anusha is a member of the 2022–2024 ICSC Next Generation Leadership Network and serves as ICSC NextGen Chair for the Gulf-South region.

Make sure you’re staying on top of the latest trends, newest developments, and hottest new stores in Huntsville by subscribing to our blog updates!

CRUNKLETON COMMERCIAL REAL ESTATE GROUP

INFO@CRUNKLETONASSOCIATES.COM

256-536-8809

DEVELOPMENT | LEASING | BROKERAGE | PROPERTY MANAGEMENT | INVESTMENT CONSULTING